Construction Loans

How Our Construction Loan Works:

- Initial Funding: Funds are disbursed in stages to cover construction costs, ensuring your project stays on track.

- Interest-Only Payments: During the 12-month construction period, make interest-only payments to keep costs manageable.

- More Flexibility: After completing the construction loan phase, choose the best loan terms for the permanent loan.

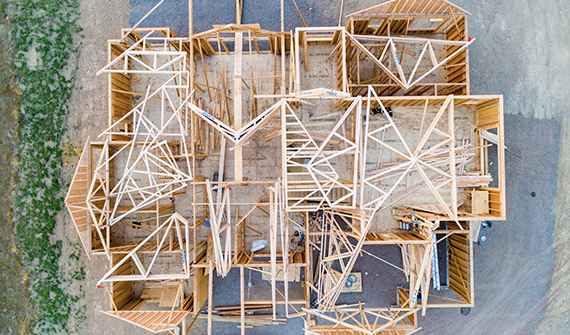

Build Your Dream Home with A Construction Loan

Building a home is a big project. We’re here to make the financing feel simpler. Whether you're working with a contractor or building on your own, our construction loans offer flexible financing to help you turn your vision into reality. With competitive rates and a team of experienced construction lenders, we’re here to guide you from blueprint to final inspection.

Construction Loan Features

- Competitive Rate

- Local Expertise

- Low 1% Origination Fee

- 12-Month Construction Term

- Up to Two Draws per Month

- Interest-Only Monthly Payments

- Refund of up to $500 in Fees if the Loan is Paid Off Before 9 Months

Ready to Get Started?

Contact our Real Estate Lending team today to learn more and get pre-qualified for your construction loan.

What You’ll Need to Apply

Gathering your documents early can help keep things moving. We’ll ask for:

-

Income & Assets

- Year-to-Date Paystub

- Two Years of Federal Tax Returns

- Two Months of Bank Statements

- Proof of Lot Purchase, if Applicable

- Insurance Agent Agency Contact Information

-

Builder Information

- Signed Builder Contract with Completion Timeline & Pricing

- Copy of Builder’s License

-

Construction Details

- Line-by-Line Cost Breakdown

- Plans & Specifications

- Room-by-Room Material Selections

Build with Confidence

Construction can be complicated, but your financing doesn’t have to be. We’re here to support your build with clear guidance, flexible options, and a team you can count on. Ready to apply? Contact one of our construction lenders today or click below to get started on your loan application. *For qualified members

Beehive offers mortgage loans, even in areas where flood insurance is required. The National Flood Insurance Program (NFIP) is a federal program that provides flood insurance, manages floodplains, and develops flood hazard zones. Federal law mandates flood insurance for members borrowing funds in high-risk areas.

Can you remove the flood insurance requirement? Members can hire a qualified surveyor to perform an elevation certificate for their home. This certificate, along with an application, can be submitted to FEMA for a Letter of Map Amendment (LOMA). A LOMA is an official amendment to an NFIP map, establishing whether a property is in the Special Flood Hazard Area (SFHA). LOMAs are typically issued when a property was mistakenly identified as being in a floodplain but is actually on natural high ground above the base flood elevation. Once issued, the LOMA becomes part of the public record and must be maintained by the community.